Adjustment entries are an essential part of financial statements, particularly in the balance sheet and income statement. These entries are made at the end of an accounting period to ensure that the financial statements accurately reflect the company’s financial position and performance. Prepaid expenses or unearned revenues – Prepaid expenses are goods or services that have been paid for by a company but have not been consumed yet.

What is the approximate value of your cash savings and other investments?

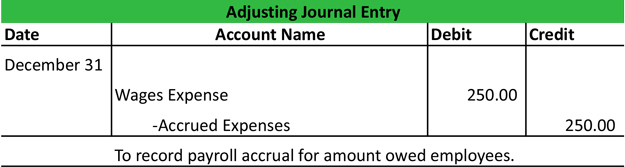

Similarly, for the company’s balance sheet on December 31 to be accurate, it must report a liability for the interest owed as of the balance sheet date. An adjusting entry is needed so that December’s interest expense is included on December’s income statement and the interest due as of December 31 is included on the December 31 balance sheet. The adjusting entry will debit Interest Expense and credit Interest Payable for the amount of interest from December 1 to December 31. One frequent mistake in adjusting entries is the failure to recognize accrued expenses. Businesses often overlook expenses that have been incurred but not yet paid, such as utilities or wages. This oversight can lead to an understatement of liabilities and expenses, distorting the financial statements.

- This is posted to the Accumulated Depreciation–Equipment T-account on the credit side (right side).

- As an example, assume a construction company begins construction in one period but does not invoice the customer until the work is complete in six months.

- The accounting period is the period of time for which financial statements are prepared, usually one year.

What are the 4 types of adjustments in accounting?

A liability account that reports amounts received in advance of providing goods or services. When the goods or services are provided, this account balance is decreased and a revenue account is increased. A word used by accountants to communicate that an expense has occurred and needs to be recognized on the income statement even though no payment was made. The second part of the necessary entry will be a credit to a liability account. This is posted to the Salaries Expense T-account on the debit side (left side). You will notice there is already a debit balance in this account from the January 20 employee salary expense.

Unearned Revenue Adjustments Tutorial (clickable link)

When your business makes an expense that will benefit more than one accounting period, such as paying insurance in advance for the year, this expense is recognized as a prepaid expense. Adjusting entries update previously recorded journal entries, so that revenue and expenses are recognized at the time they occur. The life of a business is divided into accounting periods, which is the time frame (usually a fiscal year) for which a business chooses to prepare its financial statements. Adjustment entries can impact a business’s cash flow by affecting the timing of cash inflows and outflows.

The number and variety of adjustments needed at the end of the accounting period differ depending on the size and nature of the business. The process of recording such transactions in the books is known as making adjustments. An adjustment can also be defined as making a work in progress inventory correct record of a transaction that has not been entered, or which has been recorded in an incomplete or incorrect way. Before exploring adjusting entries in greater depth, let’s first consider accounting adjustments, why we need adjustments, and what their effects are.

This principle only applies to the accrual basis of accounting, however. If your business uses the cash basis method, there’s no need for adjusting entries. At first, you record the cash in December into accounts receivable as profit expected to be received in the future. Then, in February, when the client pays, an adjusting entry needs to be made to record the receivable as cash.

Our Explanation of Adjusting Entries gives you a process and an understanding of how to make the adjusting entries in order to have an accurate balance sheet and income statement. Eight examples including T-accounts for the 16 related general ledger accounts provide makes this topic easier to master. Adjustment entries can also impact a business’s profitability by affecting the amount of revenue and expenses that are recorded in a particular accounting period. For example, if an adjustment entry is made to increase revenue, this will increase the business’s profitability for that period.

The entry records any unrecognized income or expenses for the accounting period, such as when a transaction starts in one accounting period and ends in a later period. Further, the company has a liability or obligation for the unpaid interest up to the end of the accounting period. What the accountant is saying is that an accrual-type adjusting journal entry needs to be recorded. The balance sheet is also affected by adjusting entries, as these adjustments ensure that assets, liabilities, and equity are accurately reported. For example, accruals for unpaid expenses increase liabilities, providing a more realistic picture of the company’s obligations. Deferrals, on the other hand, adjust the timing of revenue and expense recognition, impacting both the asset and liability sections of the balance sheet.

This is posted to the Depreciation Expense–Equipment T-account on the debit side (left side). This is posted to the Accumulated Depreciation–Equipment T-account on the credit side (right side). Once you have journalized all of your adjusting entries, the next step is posting the entries to your ledger. Posting adjusting entries is no different than posting the regular daily journal entries. T-accounts will be the visual representation for the Printing Plus general ledger.

It is important to note that adjusting entries should only be made by a qualified accountant or bookkeeper who has a thorough understanding of accounting principles and practices. In other words, we are dividing income and expenses into the amounts that were used in the current period and deferring the amounts that are going to be used in future periods. Without adjusting entries to the journal, there would remain unresolved transactions that are yet to close. In February, you record the money you’ll need to pay the contractor as an accrued expense, debiting your labor expenses account. Suppose in February you hire a contract worker to help you out with your tote bags.