For the past 52 years, Harold Averkamp (CPA, MBA) hasworked as an accounting supervisor, manager, consultant, university instructor, and innovator in teaching accounting online. Recording such transactions in the books is known as making adjustments at the end of the trading period. An adjustment involves making a correct record of a transaction that has not been recorded or that has been entered in an incomplete or wrong way.

How confident are you in your long term financial plan?

- Most accounting software has built-in features that allow for the easy creation and recording of adjustment entries.

- When the goods or services are provided, this account balance is decreased and a revenue account is increased.

- Even though you’re paid now, you need to make sure the revenue is recorded in the month you perform the service and actually incur the prepaid expenses.

- For instance, if a company buys a building that’s expected to last for 10 years for $20,000, that $20,000 will be expensed throughout the entirety of the 10 years, rather than when the building is purchased.

- The four types of adjustments in accounting include accruals, deferrals, reclassifications, and estimates.

Similarly, prepaid expenses, such as insurance or rent, are initially recorded as assets. Over time, as the benefit of these prepaid expenses is realized, the asset is reduced, and the expense is recognized. An adjusting journal entry involves an income statement account (revenue or expense) along with a balance sheet account (asset or liability). It typically relates to the balance sheet accounts for accumulated depreciation, allowance for doubtful accounts, accrued expenses, accrued income, prepaid expenses, deferred revenue, and unearned revenue.

Unearned Revenues

Therefore, the entries made that at the end of the accounting year to update and correct the accounting records are called adjusting entries. Therefore, it is considered essential that only those items of expenses, losses, incomes, and gains should be included in the Trading and Profit and Loss Account relating to the current accounting period. With the Deskera platform, your entire double-entry bookkeeping (including adjusting entries) can be automated in just a few clicks. Every time a sales invoice is issued, the appropriate journal entry is automatically created by the system to the corresponding receivable or sales account. That’s why most companies use cloud accounting software to streamline their adjusting entries and other financial transactions.

Which of these is most important for your financial advisor to have?

This can happen when invoices are not properly recorded or when estimates are not updated. To avoid this mistake, it is important to keep track of all invoices and ensure that they are recorded accurately. Adjustment entries can also impact a business’s stock-based compensation expenses. For example, if an adjustment entry is made to increase the fair value of stock options that were granted to employees, this will increase the amount of compensation expense that the business records.

This means the company pays for the insurance but doesn’t actually get the full benefit of the insurance contract until the end of the six-month period. This transaction is recorded as a prepayment until the expenses are incurred. Only expenses that are incurred are recorded, the rest are booked as prepaid expenses. According to the accrual concept of accounting, revenue is recognized in the period in which it is earned, and expenses are recognized in the period in which they are incurred. Some business transactions affect the revenues and expenses of more than one accounting period.

The choice of method can impact the financial statements and tax liabilities. Adjustment entries are accounting entries made at the end of an accounting period to record transactions that understanding the importance of technical excellence in enterprise agility have occurred but have not yet been recorded. These entries are necessary to ensure that financial statements accurately reflect the company’s financial position and performance.

One of the main financial statements (along with the balance sheet, the statement of cash flows, and the statement of stockholders’ equity). The income statement is also referred to as the profit and loss statement, P&L, statement of income, and the statement of operations. The income statement reports the revenues, gains, expenses, losses, net income and other totals for the period of time shown in the heading of the statement. If a company’s stock is publicly traded, earnings per share must appear on the face of the income statement. The accounting method under which revenues are recognized on the income statement when they are earned (rather than when the cash is received). For the company’s December income statement to accurately report the company’s profitability, it must include all of the company’s December expenses—not just the expenses that were paid.

Your financial statements will be inaccurate—which is bad news, since you need financial statements to make informed business decisions and accurately file taxes. In the accounting cycle, adjusting entries are made prior to preparing a trial balance and generating financial statements. For example, going back to the example above, say your customer called after getting the bill and asked for a 5% discount. If you granted the discount, you could post an adjusting journal entry to reduce accounts receivable and revenue by $250 (5% of $5,000). Adjusting entries are changes to journal entries you’ve already recorded. Specifically, they make sure that the numbers you have recorded match up to the correct accounting periods.

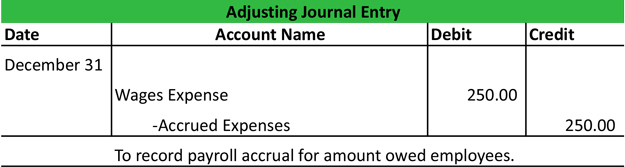

You will become more valuable as you prepare to pass this 40-question exam. It is normal to make entries in the accounting records on a cash basis (i.e., revenues and expenses actually received and paid). An example of an adjusting entry is the accrual of unpaid wages at the end of an accounting period.

Want to learn more about recording transactions as debit and credit entries for your small business accounting? These prepayments are first recorded as assets, and as time passes by, they are expensed through adjusting entries. When you make adjusting entries, you’re recording business transactions accurately in time.