For example, you may have estimated certain invoices that are later solidified with an actual number. The most popular plan, at $37 per month, is aimed at growing small businesses. Along with features offered by Early, the Growing plan places no limit on the number of invoices or quotes sent along with entering unlimited bills.

Best Practices in Developing a Chart of Accounts for a Construction Company

Construction accounting software performs project accounting specifically developed for construction projects. These solutions track financial data in real time while monitoring expenses (like the cost of materials and labor). Use software to streamline your revenue reports, invoicing, and payroll processes The Significance of Construction Bookkeeping for Streamlining Projects to stay on top of your company’s finances.

Industry Focus

- The platform manages the request through the documentation provided by vendors.

- With the completed contract method, you recognize revenue only after completing a project.

- This method of revenue recognition allows you to recognize your gains and losses related to the project in every reporting period during which the project is active.

- Direct costs in construction accounting are the expenses that can be directly traced to a specific job.

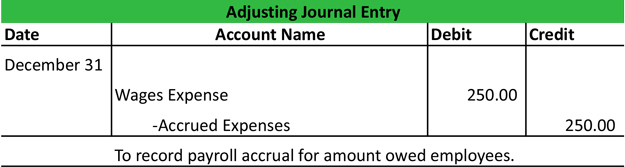

- An accrual accounting system records transactions, like sales, immediately, even if money isn’t exchanged until later.

To stay on top of cash flow and keep your books in check, you will need a flexible yet organized construction accounting system. Accounting is an essential part of running a successful construction business. However, managing your business finances correctly doesn’t always come naturally—especially if you’re not much of a numbers person. What’s more, accounting for construction company finances has some unique challenges compared to other types of businesses. Setting up and managing payroll is often part of the bookkeeping process in a small business. Some businesses use separate payroll software, which can connect or integrate into any bookkeeping or accounting software system.

More Profitable Projects

We couldn’t find any third-party sources with estimated pricing, either, which likely means the starting cost is both highly individualized and quite high. You can use Botkeeper to connect your books to your bank account and simplify reporting. It can also organize and pay bills for you, as well as collect payments and follow up on outstanding invoices.

When it comes to the construction industry, accounting is one of the most important aspects of a successful business. With each new contract comes a new set of expenses and incomes—new inventory to track and manage, new invoices to send and receive, and new accounts to keep organized. Job costing is a method for allocating expenses and revenue to each specific job. Not only will this help you prepare for tax time, but it provides an accurate accounting of profitability for each contract. Since construction accounting is project-centric, you’ll need a way to track, categorize, and report transactions for each job. With a cash account system, you’ll record transactions anytime cash changes hands.

You can create reports instantly, helping you with planning and forecasting. The whole system has bank integration so that you don’t have to waste time with time-consuming reconciliations. Depending on your needs, QuickBooks can work as a construction accounting software. It offers an option to create a schedule of values for progress billing, but it can be clunky compared to purpose-built construction accounting software. Getting a quick response through their customer support line can also be challenging, which should be considered for busy construction businesses.

The magic happens when our intuitive software and real, human support come together. But if you https://www.inkl.com/news/the-significance-of-construction-bookkeeping-for-streamlining-projects run a midsize, large, or enterprise-level business, you’ll need more features than QuickBooks can provide. We recommend Jonas Premier, CMiC, or another construction ERP software instead. COINS’s software pricing isn’t listed online, so you’ll need to contact the company directly for a quote.

However, these rates may vary depending on the size of your company, the number of jobs and employees you manage, and your unique needs. You’ll also want to categorize these expenses by service, and by individual job so you can easily track how much money came in as well as how much you spent on expenses. Using an expense tracker and saving your receipts can help you keep track of all of your expenses and project profits on each job. Though often used interchangeably, bookkeeping and accounting are distinct functions.

Fixed-Price (Lump-Sum) Billing

Here are some of the categories we used to rank the providers that made the top of the list. Success in the construction industry depends on a lot of things—accurate projections, quality work, timely delivery, and a strong professional reputation, to name a few. However, these essential traits of a successful construction business don’t end on the job site. If you can bring the same excellence to your accounting, you’ll begin to see the results of your growth firsthand.